mass tax connect estimated tax payment

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Please enable JavaScript to view the page content.

Massachusetts Sales Tax Small Business Guide Truic

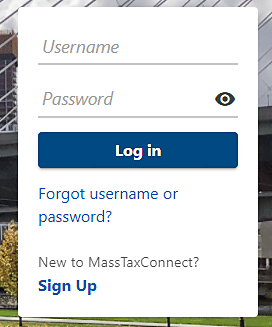

Make a Payment with MassTaxConnect.

. Select Payment Type choose Return Payment for year 2019 if paying the. Select the Returns hyperlink to choose the. Make bill payments return.

Call 617 887-6367 or 800 392-6089. The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Learn what e-filing and payment options are available and. Youll learn how to pay a tax bill or make an extension or estimated tax payment using the. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Final Results _____ Total Estimated Tax For This Year. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Your average tax rate is 1198 and your.

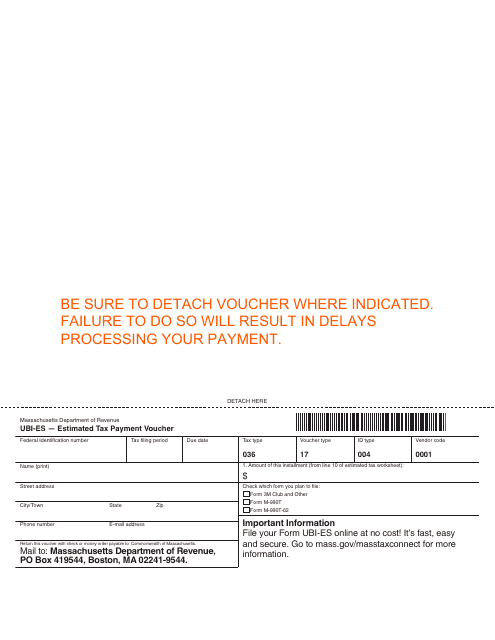

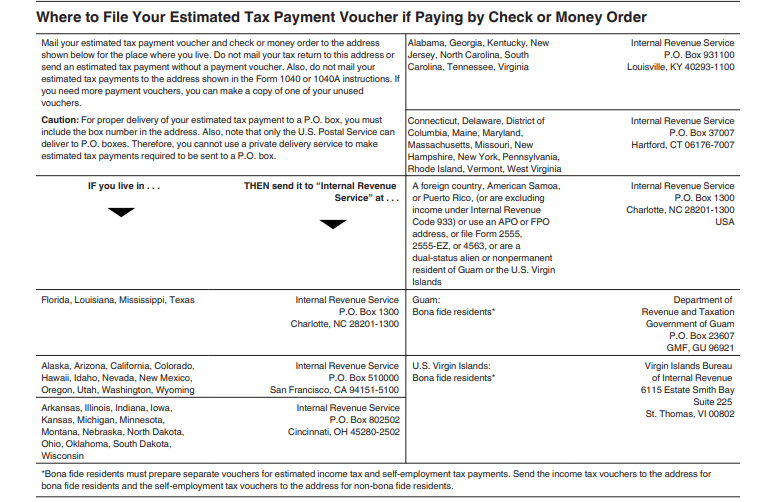

Visit DOR Personal Income and Fiduciary estimated tax payments. Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. ONLINE MASS DOR TAX PAYMENT PROCESS STEP 1.

Submit and amend most tax returns. Your Tax Amount is Less Than. Please Enter 2021 Overpayment Amount.

For business and individual taxpayers. Please enable JavaScript to view the page content. With a MassTaxConnect account you can.

Your support ID is. Access account information 24 hours a day 7 days a week. Please enable JavaScript to view the page content.

Keep an eye out on our ever-changing frequently updated FAQ page on massgovdor. Massachusetts Income Tax Calculator 2021. Please Enter 2022 MA Withholding Amount.

Log in to MassTaxConnect. E-filing is the fastest way to file your Massachusetts personal income tax return and get your refund from DOR. Individuals and fiduciaries can make estimated tax payments with MassTaxConnect.

Select the account type that you are making a payment on. Use this link to log into Mass Depa. Your support ID is.

Download or print the 2021 Massachusetts Form 355-ES Corporate Estimated Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Your support ID is. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Please enable JavaScript to view the page content. Your support ID is.

Mass tax connect make estimated payment Thursday June 23 2022 Edit. Read on for a step by step guide on making tax payments in MA.

2019 Colorado Estimated Tax Payment Voucher

How To Make An Estimated Tax Payment In Ma Archives Cozby Company

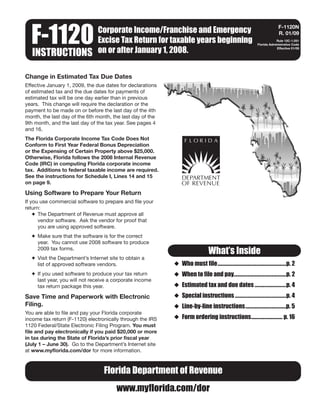

Instructions For Preparing Form F 1120 For 2008 Tax Year R 01 09

Corporate Minimum Tax Examples Apple Would Likely Pay More 3m Would Not Itep

Estimated Tax Payments Due Dates Block Advisors

How Much Does It Cost To Get Your Taxes Done Ramseysolutions Com

State By State Guide To Economic Nexus Laws

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

What Happens If You Miss The Income Tax Deadline Forbes Advisor

Strategies For Minimizing Estimated Tax Payments

Massachusetts Dept Of Revenue Massrevenue Twitter

How To Calculate Cannabis Taxes At Your Dispensary

Estimated Tax Due Dates Do I Still Need To Pay

Massachusetts Dept Of Revenue Massrevenue Twitter